Texas CEO Summit in Dallas-Fort Worth

TEXAS CEO SUMMITLEGENDS OF CRE ON CORPORATE RELOCATION, DEVELOPMENT AND WHAT'S NEXTEvent Ended On: Wednesday June 8 2022 THE...

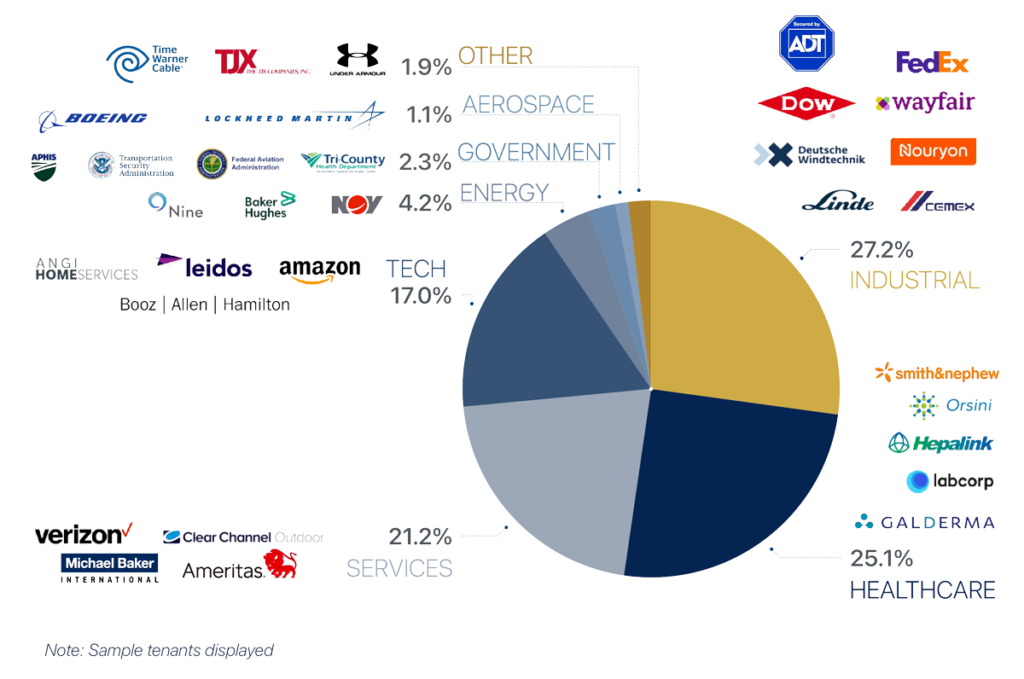

Tenant |

Tickler |

|---|---|

|

NYSE: LH |

|

Nasdaq: ANGI |

|

NYSE: W |

|

NYSE: DOW |

|

NYSE: CCO |

|

XETRA: COP.DE |

|

NYSE: NINE |

|

SHE: 002399 |

|

NYSE: FDX |

|

NYSE: NOV |

Tenant |

Tickler |

|---|---|

|

NYSE: BKR |

|

NYSE: CX |

|

NYSE: LDOS |

|

Nasdaq: PRIM |

|

Nasdaq: NSIT |

|

NYSE: BA |

|

NYSE: ADT |

|

NYSE: BKD |

|

NYSE: CHTR |

|

Nasdaq: IESC

|

Tenant |

Tickler |

|---|---|

|

NYSE: ITGR |

|

NYSE: LIN |

|

NYSE: BAH |

|

NYSE: LMT |

|

NYSE: SAIC |

|

NYSE: GD |

|

NYSE: TJX |

|

SWISS: KNIN |

|

NYSE: GPC |

|

NYSE: UA |

Tenant |

Tickler |

|---|---|

|

NYSE: VZ |

|

NYSE: FRC |

|

Nasdaq: AMZN |

|

NYSE: MOH |

|

Nasdaq: VSAT |

|

TMX: CCHWF |

|

Nasdaq: LHCG |

|

Nasdaq: AVNW |

|

NYSE: SNN |

|

Nasdaq: PAA |

Current

Anual Yied

Select the amount you are interested in investing in real estate and compare the estimated profit you can receive annually with ICP.

Contribution | Revenue 9% annual fixed | Yield on contribution | |

|---|---|---|---|

Year 1 | $100,000 USD | $9,239 | 9.2% |

Year 2 | $10,093 | 10.0% | |

Year 3 | $11,025 | 11.0% | |

Year 4 | $12,044 | 12.0% | |

Year 5 | $13,156 | 13.1% | |

Year 6 | $14,372 | 14.3% | |

Year 7 | $15,700 | 15.7% | |

Year 8 | $17,150 | 17.1% | |

Year 9 | $18,735 | 18.7% | |

Year 10 | $20,466 | 20.4% |

Contribution | Revenue 9% annual fixed | Yield on contribution | |

|---|---|---|---|

Year 1 | $250,000 USD | $23,098 | 9.2% |

Year 2 | $25,232 | 10.0% | |

Year 3 | $27,563 | 11.0% | |

Year 4 | $30,109 | 12.0% | |

Year 5 | $32,891 | 13.1% | |

Year 6 | $35,930 | 14.3% | |

Year 7 | $39,249 | 15.7% | |

Year 8 | $42,876 | 17.1% | |

Year 9 | $46,837 | 18.7% | |

Year 10 | $51,164 | 20.4% |

Contribution | Revenue 9% annual fixed | Yield on contribution | |

|---|---|---|---|

Year 1 | $500,000 USD | $46,195 | 9.2% |

Year 2 | $50,463 | 10.1% | |

Year 3 | $55,125 | 11.0% | |

Year 4 | $60,218 | 12.0% | |

Year 5 | $65,782 | 13.2% | |

Year 6 | $71,860 | 14.4% | |

Year 7 | $78,499 | 15.7% | |

Year 8 | $85,751 | 17.2% | |

Year 9 | $93,674 | 18.7% | |

Year 10 | $102,328 | 20.5% |

* Subject to a 2% entrance fee

* Gross return, made up of quarterly distribution for income distribution and capital revaluation with capital gains from properties.

** Calculation considering a continuous reinvestment of the annual return.

Aportación | Ganancia 8% anual fijo | Rendimiento Sobre aportación | |

|---|---|---|---|

Año 1 | $2,000,000 MXN | $163,636 | 8.2% |

Año 2 | $177,025 | 8.9% | |

Año 3 | $191,508 | 9.6% | |

Año 4 | $207,177 | 10.4% | |

Año 5 | $224,128 | 11.2% | |

Año 6 | $242,466 | 12.1% | |

Año 7 | $262,304 | 13.1% | |

Año 8 | $283,765 | 14.2% | |

Año 9 | $306,982 | 15.3% | |

Año 10 | $332,099 | 16.6% |

Aportación | Ganancia 8% anual fijo | Rendimiento Sobre aportación | |

|---|---|---|---|

Año 1 | $5,000,000 MXN | $409,090 | 8.2% |

Año 2 | $442,561 | 8.9% | |

Año 3 | $478,771 | 9.6% | |

Año 4 | $517,943 | 10.4% | |

Año 5 | $560,320 | 11.2% | |

Año 6 | $606,164 | 12.1% | |

Año 7 | $655,760 | 13.1% | |

Año 8 | $709,412 | 14.2% | |

Año 9 | $767,455 | 15.3% | |

Año 10 | $830,247 | 16.6% |

Aportación | Ganancia 8% anual fijo | Rendimiento Sobre aportación | |

|---|---|---|---|

Año 1 | $10,000,000 MXN | $818,181 | 8.2% |

Año 2 | $885,123 | 8.9% | |

Año 3 | $957,542 | 9.6% | |

Año 4 | $1,035,886 | 10.4% | |

Año 5 | $1,120,640 | 11.2% | |

Año 6 | $1,212,329 | 12.1% | |

Año 7 | $1,311,519 | 13.1% | |

Año 8 | $1,418,825 | 14.2% | |

Año 9 | $1,534,911 | 15.3% | |

Año 10 | $1,660,494 | 16.6% |

*Sin considerar comisión de entrada del 2%

* Rentabilidad bruta, compuesta por reparto trimestral por distribución de rentas y revalorización de capital con plusvalías de inmuebles.

** Cálculo considerando una reinversión continua de la rentabilidad anual.

We have the legal structure to serve any Mexican natural or legal person, and an LLC structure to serve North American natural and legal persons.

On a quarterly basis, the portfolio distributes the profits from the rental income to investors. The distribution currency is in dollars that can be paid in American or Mexican accounts at the exchange rate on the day of distribution. A capital revaluation derived from rent increases is recognized annually.

Investors' capital is directly backed by the portfolio's real estate portfolio. The yield is protected with long-term rental contracts, mainly with North American investment-grade public companies.

The investment entry amount is 2 million pesos or $100,000 USD. Once invested, you can make contributions of discretionary amounts. The investment period is open, compulsory the first two years. There is an entry commission of 2% on the amounts invested.

The investor can withdraw totally or partially from month 24. Withdrawals are quarterly, without commissions or penalties.

TEXAS CEO SUMMITLEGENDS OF CRE ON CORPORATE RELOCATION, DEVELOPMENT AND WHAT'S NEXTEvent Ended On: Wednesday June 8 2022 THE...

2023 Capital Real Estate | Política de Privacidad