We invest in high-quality multifamily assets in strong markets with value-add strategies generating attractive returns for our investors.

Our Business Model

Track Record

Current Portfolio

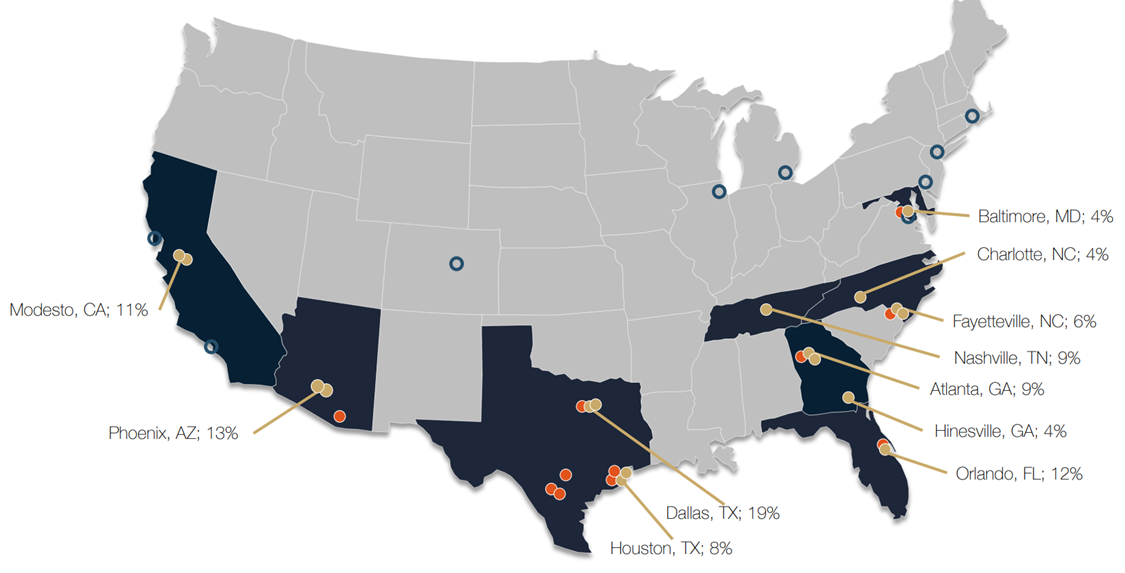

CAPX’s Investment Portfolio

Properties

We are continually selecting the best multifamily properties aliened to our investment strategy. Our management team is fully focused in seeking to maximize risk-adjusted returns; building a solid and diversified portfolio through value-add and high-yield investment strategies in different markets.

Discover what CAPX can offer you

Select the amount you are interested in investing in real estate and compare the estimated profit you can receive annually with CAPX.

- $100,000

- $250,000

- $500,000

Contribution | Capital Gains 12% annual IRR | Return on invested capital | Capital Gains 15% annual IRR | Return on invested capital | |

|---|---|---|---|---|---|

Year 1 | $100,000 USD | $112,000 | 12.0% | $115,000 | 15.0% |

Year 2 | $125,440 | 13.4% | $132,250 | 17.3% | |

Year 3 | $140,493 | 15.1% | $152,088 | 19.8% | |

Year 4 | $157,352 | 16.9% | $174,901 | 22.8% | |

Year 5 | $176,234 | 18.9% | $201,136 | 26.2% | |

Year 6 | $197,382 | 21.1% | $231,306 | 30.2% |

Contribution | Capital Gains 12% annual IRR | Return on invested capital | Capital Gains 15% annual IRR | Return on invested capital | |

|---|---|---|---|---|---|

Year 1 | $250,000 USD | $280,000 | 12.0% | $287,500 | 15.0% |

Year 2 | $313,600 | 13.4% | $330,625 | 17.3% | |

Year 3 | $351,232 | 15.1% | $380,219 | 19.8% | |

Year 4 | $393,380 | 16.9% | $437,252 | 22.8% | |

Year 5 | $440,585 | 18.9% | $502,839 | 26.2% | |

Year 6 | $493,456 | 21.1% | $578,265 | 30.2% |

Contribution | Capital Gains 12% annual IRR | Return on invested capital | Capital Gains 15% annual IRR | Return on invested capital | |

|---|---|---|---|---|---|

Year 1 | $500,000 USD | $560,000 | 12.0% | $575,000 | 15.0% |

Year 2 | $627,200 | 13.4% | $661,250 | 17.3% | |

Year 3 | $702,464 | 15.1% | $760,438 | 19.8% | |

Year 4 | $786,760 | 16.9% | $874,503 | 22.8% | |

Year 5 | $881,170 | 18.9% | $1,005,679 | 26.2% | |

Year 6 | $986,912 | 21.1% | $1,156,530 | 30.2% |

* Subjet to a 2% entrance fee

*Gross IRR, made up of annual distribution and capital revaluation with capital gains from properties.

** Calculation considering a continuous reinverstement of the annual return

Important Information

We have the legal structure to serve any Mexican natural or legal person, and an LLC structure to serve North American natural and legal persons.

On an annual basis, the portfolio distributes the profits from the income from the sale of properties to investors. The distribution currency is in dollars that can be paid in American or Mexican accounts at the exchange rate on the day of distribution. Likewise, a gain is recognized in the goodwill of the properties that were not sold at the time of departure.

Investors' capital is directly backed by the portfolio's real estate portfolio. The income is generated by the sale of the properties in conjunction with housing rental contracts in the American middle class segment.

The investment entry amount is 2 million pesos or $100,000 USD. Once invested, you can make contributions of discretionary amounts. The investment period is open, compulsory the first two years. There is an entry commission of 2% on the amounts invested.

The investor can withdraw totally or partially from month 24. Withdrawals are quarterly, without commissions or penalties.

Invest Safe in the US

Contacto

- Monterrey - CDMX

- contacto@capitalre.mx

- 81 1972 0333

- 81 1972 0444

2023 Capital Real Estate | Política de Privacidad