We invest in high-quality multifamily assets in strong markets with value-add strategies generating attractive returns for our investors.

Our Business Model

Track Record on Realized Investments

Active Portfolio

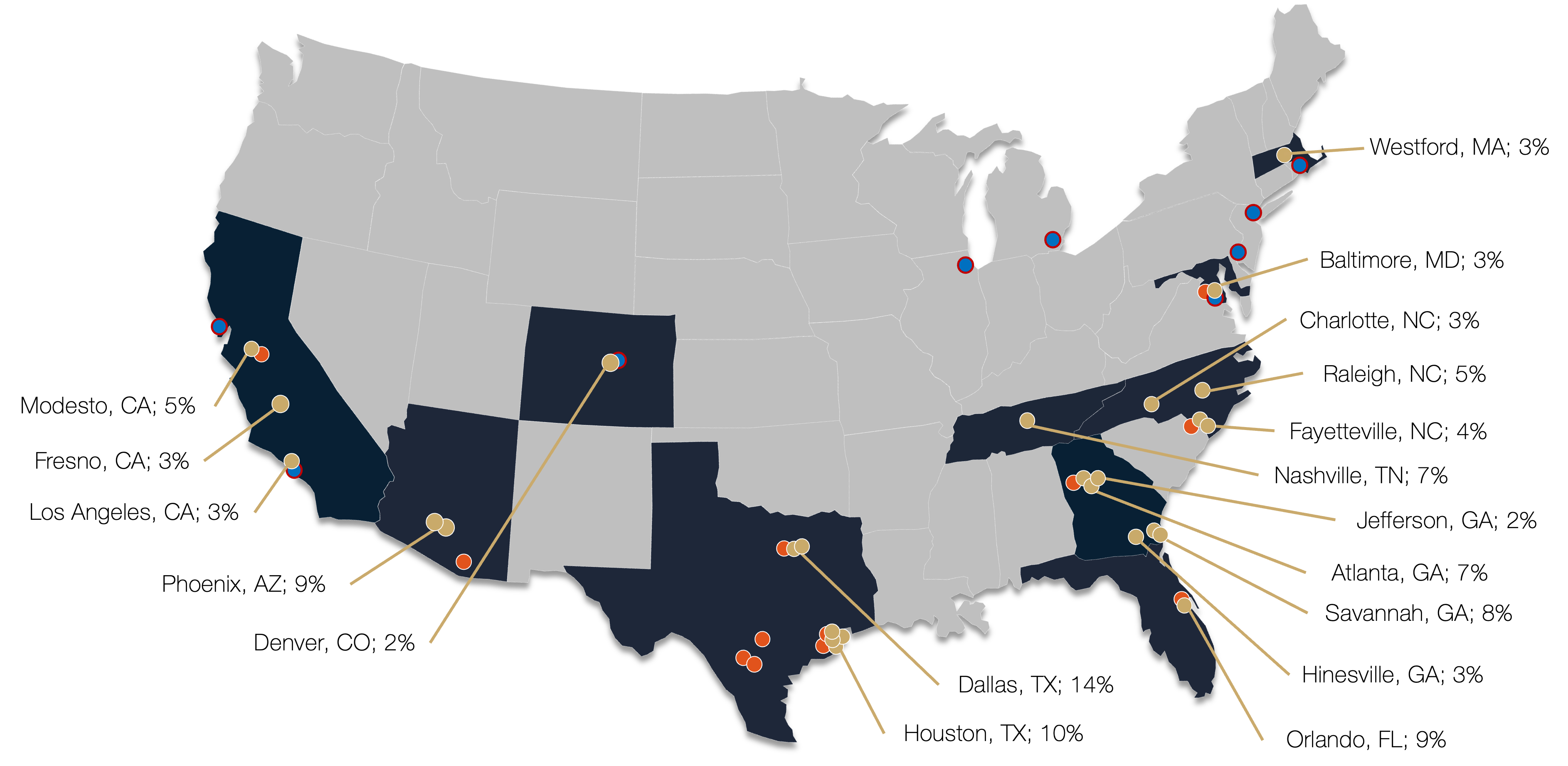

CAPX’s Investment Portfolio

Active Properties in Portfolio

We are continuously selecting the best multifamily properties aligned to our investment strategy. Our management team is fully focused in seeking to maximize risk-adjusted returns; building a solid and diversified portfolio through value-add and high-yield investment strategies in different markets.

Dispositions

Properties that have been in the CAPX Multifamily Fund and are now part of our Track Record, as they became realized investments.

Discover what CAPX can offer you

Select your investment amount to see how your estimated equity could increase over time with CAPX under different return scenarios.

- $100,000

- $250,000

- $500,000

10% Annual IRR | 15% Annual IRR | ||||

|---|---|---|---|---|---|

Contribution | Estimated Capital | Return on invested capital | Estimated Capital | Return on invested capital | |

Investment | $100,000 USD | ||||

Year 1 | $110,000 | 10.0% | $115,000 | 15.0% | |

Year 2 | $121,000 | 21.0% | $132,250 | 32.3% | |

Year 3 | $133,100 | 33.1% | $152,088 | 52.1% | |

Year 4 | $146,410 | 46.4% | $174,901 | 74.9% | |

Year 5 | $161,093 | 61.1% | $201,213 | 101.2% | |

Year 6 | $177,202 | 77.2% | $231,395 | 131.4% | |

10% Annual IRR | 15% Annual IRR | ||||

|---|---|---|---|---|---|

Contribution | Estimated Capital | Return on invested capital | Estimated Capital | Return on invested capital | |

Investment | $250,000 USD | ||||

Year 1 | $275,000 | 10.0% | $287,500 | 15.0% | |

Year 2 | $302,500 | 21.0% | $330,625 | 32.3% | |

Year 3 | $332,750 | 33.1% | $380,219 | 52.1% | |

Year 4 | $366,025 | 46.4% | $437,252 | 74.9% | |

Year 5 | $402,733 | 61.1% | $503,032 | 101.2% | |

Year 6 | $443,006 | 77.2% | $578,487 | 131.4% | |

10% Annual IRR | 15% Annual IRR | ||||

|---|---|---|---|---|---|

Contribution | Estimated Capital | Return on invested capital | Estimated Capital | Return on invested capital | |

Investment | $500,000 USD | ||||

Year 1 | $550,000 | 10.0% | $575,000 | 15.0% | |

Year 2 | $605,000 | 21.0% | $661,250 | 32.3% | |

Year 3 | $665,500 | 33.1% | $760,438 | 52.1% | |

Year 4 | $732,050 | 46.4% | $874,503 | 74.9% | |

Year 5 | $805,465 | 61.1% | $1,006,064 | 101.2% | |

Year 6 | $886,012 | 77.2% | $1,156,973 | 131.4% | |

*The annual IRR is published quarterly to reflect the aggregated estimated return of all unrealized investments (active properties)

** The estimated capital is updated using the latest published IRR, applied as a compound annual rate over the entire period the capital has been invested

Important Information

CAPX is open to both Mexican investors (individual and legal entities) through a S.A.P.I. structure, and to US investors through a US-based LLC. This allows a seamless, compliant investment across borders.

Investors benefit from a risk-adjusted return and the diversification and resilience of a professionally managed real estate portfolio. This return is reflected in an estimated annual IRR, updated quarterly, which (as a compound rate) drives growth in their estimated equity value over time.

Investor capital is backed by a diversified portfolio of U.S. multifamily real estate assets. These properties generate rental income and are professionally managed to enhance operational efficiency and value creation.

Minimum initial investment is $100,000 USD (or MXN equivalent). Additional contributions may be made at the investor's discretion, without restrictions on amount or timing. The investment is open-ended, subject to a lock-up period of 2 years.

A 2% entrance fee (one-time) applies to all invested amounts.

After the 2-year lock-up period, the investor may request for a partial or full redemption. Withdrawals are processed on a quarterly basis subject to the fund's liquidity.

Invest Safe in the US

Contacto

- Monterrey - CDMX

- contacto@capitalre.mx

- 81 1972 0333

- 81 1972 0444

2023 Capital Real Estate | Política de Privacidad